If you’re like most homeowners (or aspiring ones), you’ve encountered lots of online listings and automated valuation models (or AVMs) — from the Redfin Estimate to the Zestimate. Who doesn’t love looking up their home and getting that dopamine hit of a higher number than your purchase price (hopefully)? But are they accurate or is there a better way to assess a property’s value on today’s market?

3 Things You Can Do As a Homeowner Now to Make Your Future Sale More Successful

I often talk to clients about micro-markets when it comes to real estate. Within one region or city, there often are smaller markets that have their own trends and dynamics. As a case in point, the DC condo market is currently friendlier to buyers, while we’re still seeing lack of inventory and escalation with detached homes in Chevy Chase and similar communities.

However, this isn’t a post on the ever-changing market (reach out for the latest on that, as always), rather it is about something equally important and that you can control. Regardless of the micro-market, there are several key things you can do as a homeowner to put you on the best footing when it is time to sell your home. While there are many more, my three top tips for savvy future sellers are:

1. Maintain Your Systems, Keep Your Records: Even if systems are older, they don’t have to be a barrier to buyers. Everything from your water heater to your HVAC has an estimated life and, while the actual lifespan can vary greatly, your stacking the odds in your favor for a longer lifei with regular servicing. So, sign up for the annual or biannual maintenance plan, change those filters and keep a digital or physical folder with manuals and records for easy reference when you’re ready to sell. And, if you think age of one more systems may still be a distraction, you can always opt to purchase a home warranty before you list that will transfer to the buyer and offer them peace of mind.

2. Keep Up With Cleaning: Habits matter…especially cleaning ones. As a real estate agent, I have seen the most meticulously maintained homes and ones that, while disgusting, make you feel less guilty about skipping a week of vacuuming at home. Make it your norm, beyond general housekeeping, to do a seasonal deep clean inside AND outside — emptying cabinets, scrubbing baseboards and trim, power washing and more. And, to really save money, please maintain the countertops in your kitchen and bathrooms (resealing and polishing granite 1-2 times per year, for example) and scrub that grout and strip and re-caulk bathrooms at the first signs of peeling and/or mold.

3. Consult the Pros Before Major Updates: If you know selling is on the horizon (especially in the next 1-5 years), reach out to a trusted design and real estate professional (it me) to get guidance on any and all of your plans. Some things are easier to change without much time or expense before listing (e.g., paint or a light fixture), but kitchens, baths and removing/adding walls to change spaces can easily open you up to more buyers (or turn them away). Also, don’t wait to invest in your home until it’s time to sell if it’s in your budget and it would enrich your home life now! And, just like maintenance, keep those records of expenditures so we can use them to market your home!

So, how would you rate yourself on these three areas? Real estate is powerful because its something you find daily utility in and that builds personal wealth at the same time…pour into it to maximize your enjoyment and equity today and beyond!

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Homeownership: Make the Most of Time and Don't Let It Get the Best of You

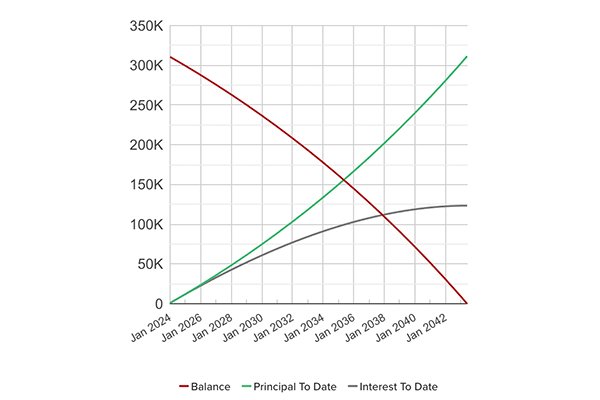

It may seem like your payments are all going to interest at first, but greater equity comes with time.

A recent post on The Atlantic proclaimed, "It Will Never Be a Good Time to Buy a House." And, while there are some hard truths outlined in the article (such as the lack of inventory and today’s higher interest rates), homeownership is about the long game and sitting on the sidelines doesn't equate to winning for most, especially if you haven't made your first investment. Renting is helping someone else gain equity or profit (if the home is owned outright), so investing in you as soon as possible is key. It can be a hard journey but we can do hard things, right?

Since numbers don't lie, let's look at an example of a first-time homebuyer who bought a two-bedroom condo in a on-the-rise neighborhood in DC ten years ago. Despite a good job, with the relatively high cost or real estate, he put down only 5% of the $429,000 sales price, understanding that this would mean an additional cost for private mortgage insurance (PMI) for a while. Closing costs, including the down payment, equated to just under $33,000 and the total monthly payment of PITI (principal, interest, taxes & insurance), PMI, and the condo fee equated to $2,750/month. At the time, the median rent for a similar unit was $2,200. Who would want to pay $550/month more? (Answer: Almost anyone planning to stay or hold onto the unit for five or more years)

After an early termination of his PMI due to him proactively requesting an appraisal due to rising property values in his neighborhood, let's fast forward to 2023. Today he is paying less than in 2013 ($2,550/month) without PMI and even with higher taxes, insurance and condo fees. That same unit would rent for $2,900/month on today's market (a 30+% increase, while he is paying 7% less than in 2013). As an owner-occupant, he'd be making out great. As an investor-landlord, he is clearly in the black -- now having someone else help him continue to gain equity and cover his mortgage (and then some). My how the tides have turned.

And this is just looking at his cost of living; however, here's the real magic: over those 10 years his property value appreciated more than 45% (or almost $200,000), while he also gained another $100,000 of equity by paying down his mortgage. During this time, he may have paid approximately $20,000 more in the early years to own vs. rent but, even with is $33,000 down payment, an investment of $53,000 that grows to $300,000 in 10 years isn't too shabby (that's just under a 19% annual return). Other benefits include stability, the peace of mind of being able to make his home own, the savings not having to move, etc. A home is one of the few investments you can enjoy while it appreciates. Even if he had sold five years in, the equity would have made a solid down payment on a new $1M+ home.

Yes, this is only one example. And, yes, interest rates back then were closer to 4% and the location of the home was on the rise...but the principals still apply. With a lack of housing supply, the S&P CoreLogic Case-Shiller Home Price Indices are near their highest inflation-adjusted levels. The price of entry may be higher but the trajectory in a vibrant market like the DC metro area is clear.

Even if your budget may be tighter due to higher interest rates and that first home may be a condo or townhouse instead of a detached home, time is your greatest asset in real estate. Whether you're in your 20s, 30s or beyond, you can crunch your numbers, make moves and invest in you. The average age of today's first-time homebuyer is at an all-time high, but that doesn't mean you can't beat the average (and I love helping first-time homebuyers make the leap with confidence). Curious in running your personal scenario? Reach out today and let's look at your financial situation, the variables you can change, and the market to see what your path may look like.

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

How to Decide If It's Time to Buy

When you ask a real estate agent, “Is now a good time to buy?” you’d probably expect to hear (or have heard), “Yes, it’s always a good time to buy!” Of course, their business is selling houses, so why would they say otherwise? If you ask me, I’d add two words to that initial question — “Is now a good time to buy…for me?” My answer: “Let’s talk and see.”

The truth is each of us is different, from our financial situations to our priorities and risk profiles, and that’s why I always walk potential buyers through a few key questions to help them determine what’s best for them.

The first question is always about timing, as the real estate market goes through cycles with peaks and valleys. Time is your friend on many levels when it comes to real estate (just check out the equity gains homeowners have seen in our area) and it’s always better to have flexibility as to when you’ll want to or need to sell (if ever). You’ll gain equity through your mortgage payments (although early on a larger portion goes to pay interest) and, depending on the micromarket (neighborhood, type of housing, etc.), you can earn quite a bit in a year. But that’s not always the case, so we want to make sure you’re okay with all scenarios — yes, even the worst case ones.

In the Washington, DC area, we are fortunate to have a less volatile market than many areas of the country. Competition may mean you have to pay more than you’d like to as a buyer at a particular moment, but time can cure that. Higher interest rates (and, yes, they may go up more after the Fed meets again soon) may not seem great when you look at the sub 3% rates of a year ago; however, 6% doesn’t look so bad when buyers paid more than 16% on average in the early 80s! It’s cliché but true: you marry the house but you date the rate. With property values on an upward trend, waiting for a lower interest rate means losing time building equity and quite likely paying a good deal more for that house in the future.

I could go on and on, but the question we started with is a personal one, so let’s move from generalizations and talk about you and your needs. Click or tap the button below to reach out for a no obligation consultation.

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Is Live-In Landlord Life for You?

The Washington, DC area is known for many things — beautiful cherry blossoms, a great dining scene and so much more…but an affordable housing market is sadly not one of them. With cities around our region regularly ranking high among U.S. locales for average home prices, many homebuyers need help nabbing their piece of the market, and one strategy for many is seeking a home that allows for rental income that helps offset the mortgage.

Being a live-in landlord or owning investment properties that you lease out requires research, reading up and planning, but it may be an option for you or someone you know. There are two primary owner-occupied options we see in our neck of the woods:

Multi-Unit Properties: A multi-unit has two or more independent units allowing for multiple individuals/families to have distinct homes in the same building. You likely are familiar with the terms duplex and triplex, which are two- and three-unit properties.

Shared Single-Family Homes: If your home is larger enough to welcome one or more person, you may elect to have a roommate. The roommate could have their own separate area of the home, like a lower level, or simply occupy a bedroom with shared bath, kitchen, etc.

In either of these types of homes, you can choose to have longer-term tenants with leases or you may opt to welcome someone on shorter, more flexible terms through Airbnb or another platform. We’ve especially seen an increase in these among Millennial homebuyers. But, before you count your leasing income on that future home, here are a few things to keep in mind:

Remember Income is Not Guaranteed: If you are only able to make a property work for your budget by renting, make sure you have a contingency fund and plan if market conditions change. You may need a buffer between tenants (and won’t have income for a period of time), see demand fluctuate (as we saw when a large number of college age students returned home during the pandemic and no longer were seeking off-campus housing, resulting in less demand and depressed prices) and/or (but hopefully not) run into tenants who can’t or won’t pay. So, know your numbers and have savings you can fall back on to ensure you can pay your mortgage if the income decreases or stops.

Understand the Rental Market: You may have recently been a renter, so put your tenant cap back on for a bit. What are your target renters looking for? As a result of the pandemic, for example, more people began relying on personal vehicles over public transportation, so is there off-street parking and, if not, how easy is to park on the street? Another consideration is that secondary units are often in lower levels of homes, which are inherently less desirable than above-grade units. When you take all of this into account, you can best price your unit to find a tenant quickly.

Know the Law: Every jurisdiction has laws that guide housing and rentals, with a focus on protecting tenants and their rights. (DC is notorious for being the most tenant-friendly jurisdiction in the U.S.) You’ll want to ensure the space you intend to rent is legal to rent, know what registrations and licenses you may need (and how much they cost) and understand regulations regarding important things like managing security deposits. As a reminder, laws are constantly evolving and you need to stay on top of those changes. One of the most recent changes that has impacted many owners limits short-term rentals for non-owner occupants but also introduces the need for short-term landlords to register with DCRA.

Be Prepared to Handle Issues: As the landlord, the responsibility falls on you to address any issues — from a broken toilet to pesky pests. This means, just as any homeowner should, you want to ensure you have funds to pay for fixes and upgrades, as needed, and ensure you make yourself available and responsive to the concerns of your tenant(s). If this gives you anxiety or is not consistent with how you want to live, landlording may not be for you. Of note, landlords who don’t share properties with their tenants sometimes will hire a professional property manager for this purpose, but that comes at a cost and is likely not a fit when you’re on site.

Talk to a Tax Professional: As you add another income source, you’ll want to ensure you account for that appropriately on your taxes. Make sure to talk to your CPA.

Do you think sharing your home may be right for you or your path to homeownership? Reach out and let’s dig in, crunch the numbers and see!

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Four Cost-Effective Updates to Sell Your Home for More Sooner

When you decide it’s time to find a new owner for your home — whether you are moving up, relocating or otherwise, once you get past the emotion and nostalgia, you likely are most focused on maximizing your return on this important investment and doing so on your terms (including finding a buyer quickly).

As both a real estate agent and decorator, I work closely with each of my clients to create a custom plan to sell their homes for top dollar swiftly. And, while each property and micro-market (location, price point, etc.) is slightly different, there are four key areas I always focus on that offer cost-effective opportunities to optimize a home for the sale — ensuring it’s the best presented option in its price range and location.

Read on for my top tips and check out a few before and afters to show you their power:

Paint & Your Overall Color Palette: Paint can be transformative and completely change the feel of a space — making it brighter, more welcoming and up-to-date (I’m looking at you yellow bathroom!). While walls are the focus, you also may want to consider painting cabinetry to say bye-bye to dated wood tones (think that original bathroom vanity in a honey tone) or just a fresh color on the front door to be on trend and intrigue buyers to schedule a tour. Another way to play with color is by changing textiles (which I often do when staging with client’s own furniture). A simple swap of a rug or set of throw pillows paired with neutral paint can transform a space and let you keep those red leather couches.

Lighting & Hardware Updates: Changing a light fixture or faucet is a simple job for a handy homeowner or a hired professional, allowing you to banish dated brass candelabras and signal a contemporary feel for buyers. Even easier is changing knobs and pulls on cabinetry (or adding them if they aren’t installed)…and, when you do both together, magic! There are so many cost-conscious fixtures available from Wayfair and other online retailers, so there’s no need to hesitate!

This home sold for for more than 14% above list with seven offers (and set a new neighborhood record). We updated the palette with fresh paint and some new textiles, built on the iron railing by adding a matte black chandelier and ceiling fan and banished that wallpaper and chair rail in the dining room..voilà!

Simplify & Streamline: Many design features are associated with a certain era (unnecessary pony walls, anybody?), and sometimes it makes sense when you are painting and making other updates to strip these away. For example, a chair rail can be beautiful but may date a dining room, and old window treatments and hardware may have seen better days (and won’t be needed by you much longer or at all). Other easy updates include removing wall mounted storage (like that shelf above a window or the cabinet above your toilet). You may have installed them to give you more room for all your things…but they also may signal to the buyer this space may not work for them.

Surface Transformations: A dated bathroom may be ready for a larger refresh, but that may not provide the ROI you need (or work on your timeline). Instead consider updating the laminate vanity countertop with a new quartz one, re-glazing an older tub and/or swapping out the entire vanity set. You also may want to remove a dated kitchen backsplash and/or add a new one to create a fresh look. While a little more involved, when paired with some of the tips above, a refresh vs. a full renovation may just what the doctor, err agent, ordered!

A pre-fab vanity with matching mirror from Home Depot was an inexpensive update (along with paint and removing an extra cabinet) that dramatically changed the way this en suite bathroom showed.

Looking for custom tips as you think about your next chapter? Reach out today for a virtual or in-person, no pressure consultation (bonus: these recommendations are equally as rewarding if you are staying in your home but watching your budget)!

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Buyer's & Agent's Eyes: What to Look for in Your Next Home

A Licensed Inspector Is a Great Resourced in Your Home Purchase — Whether Before an Offer or After (Even for Informational Purposes Only)

When it comes to identifying your next home, you may find yourself making the decision to submit an offer after only 15-30 minutes in the property (or, sometimes, without even stepping foot inside).

As an agent-buyer team, our shared goal is to find a home that fits your needs and wants — near and longer term. While a general home inspection and/or other inspections may be a part of your process (before an offer or after its accepted), we have to use our combined experience and knowledge to look out for any dealbreakers.

Often what a buyer’s eyes focus on upon the first visit is different than what an experienced agent who has seen thousands of homes may be looking for. With buyers, some of the top areas of attention include:

Kitchen: The adage is true. Kitchens sell homes, as they can be among the more costly renovations and updating a kitchen while living in a home is not ideal (ask anyone who has done it).

Primary Bedroom & Bath: If you’re paying the mortgage, you want your personal retreat to feel like just that. En suite bathrooms are preferred by most buyers who are purchasing a home with more than one bathroom, too.

Bathrooms: Like kitchens, bathroom renovations are a little more involved and, if you only have one, you want it to be perfect.

Curb Appeal: You want to walk or drive up to a lovely looking home, even if the inside is much nicer than what’s on the outside (it’s what’s on the inside that counts, right?)

Flooring, Paint Colors, etc.: If the tone ans/or width of the floors are “on trend” or the wall color is neutral, it’s easier to picture making it your own. I have yet to hear a buyer say, “Oooh, I LOVE that orange wall!”

While these features of a home are all important, most have the common theme of being more cosmetic than not (all of which can be changed when you’re ready and at a range of budgets, usually). For example, sometimes simply painting walls, trim or a vanity can be transformative and cost effective. However, as a buyer’s agent, I strive to make sure we also focus on the “less sexy” features that can turn into projects that don’t give you the same level of satisfaction as a new bathroom or quartz countertops but can drain your wallet as much or more:

Gutters, Grading and Drainage: Water is the enemy of any home. We’ll look at where it may travel when there’s a storm or otherwise (and hopefully it’s away from your home). With increasingly heavy downpours in the DC area, features like larger gutters with guards, sump pumps with battery backups, etc. are always nice to see.

Foundation Issues: While I am not a structural engineer (and you likely aren’t, as well), we can look for visible cracks or feel for sloping in floors (just pull out that handy marble). If something seems off to us, you’ll want to bring in an expert to do an assessment.

Basement Condition: This ties in with the first two, as basements can help reveal underlying/larger problems. Does it feel moist or smell musty or moldy? Do you see evidence of work — from re-poured sections of concrete to new paint and flooring? As much as we all love a finished basement, sometimes it’s great to have one with exposed ceilings and cinder block walls.

Major Systems: While a garbage disposal can be replaced for under $100, a water heater or HVAC will cost much more. Older systems shouldn’t be a non-starter if your budget and homeownership plan allows for updating them or, at the least, a comprehensive home warranty.

“The Bones": As much as possible, we want to look past the stylish finishes and pay attention to what you can’t change easily/cheaply or at all — think location, layout and underlying construction quality. If you want that brick house (right, Carolyn?), it may be better built and require less maintenance than another material.

So, does this mean we can’t look for, admire and place value in items on the first list? Of course not. But by prioritizing the second list you may find yourself considering a wider range of properties…and avoiding headache down the road!

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

What to Do When You're Ready to Buy...and Everyone Else Is, Too

Make Sure You’re Not Iced Out of Your Next Home

With everyone focused keenly on what they need and want in a home (thanks, COVID-19) and historically low interest rates, what normally would be the start of the “busy season” in DC area has been intensified to the nth degree.

With supply (number of homes for sale) and demand (number of buyers looking) so mismatched, if you’re looking for a detached home or townhome practically anywhere, you’ll likely be facing a multiple offer situation. And, while escalation clauses and pre-inspections are not uncommon in our market normally, we are seeing the number of competing offers on homes rise (we’re talking 10, 20 and more) at the same time as reasonable contingencies mean you won’t even make the short list of offers considered.

Both listing and buying agents long for a more balanced market but, until then, if you’re looking to buy you want to make sure you’re prepared and persistent. Here are a few tips to get you in the right mindset (and please reach out if you’d like a one-on-one consultation to learn more to inform you next move…now or later).

Assemble the Right Team: You can’t do this alone, so you want to ensure you have an agent who is on top of the market, strategic and responsive. The same goes for your lender (let me know if you are interested in introductions to several of the best local ones) Remember that your offer is evaluated not just on the terms but also on the parties representing you. Are they good to work with? Do they deliver on time? You want to be able to give a resounding “Yes!” to those questions about your team.

Know the Market: With the help of your Realtor, start learning about the specific market (geography, price point, house type) well before you are ready to make moves if possible. This will help you mentally prepare for the challenges and sometimes tough decisions you will face (like waiving a major contingency) in your journey.

Know Your Numbers & Thresholds: Unless your name is Bezos (or another household name), you likely have limits — in terms of your finances and your risk tolerance. Work with your lender to model out scenarios and know what you have to bring to the closing table. You very likely will be faced with a situation where you may have to make up a difference between the appraised value and contracted sales price of your future home or assume risk by waiving an inspection (or, at the least, assuming responsibility for any issues you may find). Exploring what’s right for you in advance of writing an offer will allow you to be as aggressive as you can (and need to) be in this market while not setting yourself up to be house poor.

Act Swiftly: The DMV real estate market generally moves quicker than most of the country, and I’m not just talking about closing in less than 30 days. It’s not uncommon in this market for showing appointments to be gone before a house even hits the market. By getting ahead of listings while in Coming Soon status or through your agent’s network and relationships, you can ensure you have a chance to take a swing when you find a home that hits the mark. Your speed comes in handy well beyond the initial showing — from squeezing in a pre-inspection and meeting offer deadlines to closing quickly and on time.

Understand Types of Value: If your #1 criteria in a new home is getting a steal, now is not the time to buy. That being said, if you place value in quality of life and are financially ready, there’s no reason to wait. As always, think ahead to your five- and ten-year plans and consider your exit strategy. Since you will be paying a premium most likely, it may take longer for valuations to catch up and, as with all markets, real estate goes through cycles.

It’s a lot to unpack, which is why the first bullet is always the place to start. With a solid team and preparation, your next home is in sight!

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Five Reasons Why Buying (or Selling) Now May Be a Good Move for You

As I write this, DC is entering phase II of its coronavirus re-opening plan and life pre-COVID-19 seems simultaneously like it was yesterday and ages ago. While I definitely find myself on the cautious side of the “getting back to normal” spectrum, I have been able to help many clients navigate buying and selling homes during this pandemic.

This is what an open house on your home may look like…agent with a phone, gimbal and Zoom welcoming prospective buyers and their agents.

Additionally, while we don’t have a vaccine or cure (yet), agents, lenders, title companies, inspectors, etc. have become adept at new ways of doing business, while still looking out for our clients. In fact, if you have been considering making real estate moves — from buying a first home to moving up, there are several reasons why now may be the right time to map out your plan and get started:

You’ll never be more aware of your real home needs. Pre-pandemic we all had crazy long lists of what we wanted in our next house; however, spending more time at home has helped us prioritize what really matters — whether that’s simply more square footage (indoors or outdoors) or spaces to meet specific needs, like work and working out.

Interest rates are low. Like really low. I’ve had clients lock in well below 3% recently, and this means you can afford even more house than before or save even more. If you are renting, for example, it’s not uncommon for a mortgage payment for a comparable home to be less than the rent in our area normally, and It may be even more affordable now. (Also, you don’t need 20% or even 10% down to buy.) Meanwhile, if you are selling and moving up, applying your equity to a new property at a lower interest rate is a no brainer.

There’s less “froth” in the market. While, yes, limited inventory means we are seeing multiple offers and homes going above list price often, COVID-19 has put things in perspective for everyone. I have found that means parties are more rational and cooperative than ever (no buyers asking for a new HVAC when the current one is working fine), and contract to close is the smoothest I’ve seen it.

Tech tools mean you can make the most of your time. While virtual tours aren’t new, they are being used on listings at all price points now (and buyers are becoming comfortable with making decisions sometimes based solely on them). As a seller (especially if you are living in your home while it’s listed), this means you can do a lot to market your home without having to constantly open your doors for showings and open houses, which is inconvenient and also can pose health concerns. As a buyer, you can make the most of your time but exploring properties from your computer or phone using pre-produced tours or with your agent taking you along virtually first.

Your happiness is one thing you shouldn’t put on hold. As we spend more time at home, the value of it to your mental well-being is greater than ever. While real estate is a financial investment, I often encourage my clients looking for their primary residence with a happiness filter first and we’ll still ensure they aren’t paying more than they should based on the market…that intangible value of the perfect fit is more than just icing on the cake.

3D tours allow you to walk through a home, zoom in and out and even measure distances!

If you have questions about specifics of how we can partner to navigate buying and selling safely or want to put together options for your next move, drop me a line by clicking on the button below. Here’s to happiness at home and healthy times ahead for all!

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

The Price Is Right: Pricing Your Home to Sell

Photo Credit: TaxRebate.org.uk

As I meet with clients looking to sell their homes, the first question they often have as we start our consultation is “what can we get for it?” A home is usually the most valuable asset (or one of the most valuable assets) an individual or couple has, so what you’ll come away with is undoubtedly important. However real estate, like many things in life, is negotiable so you’ll want to remember the following as you prepare to go to market:

List Price vs. Sales Price

List price and sales price often aren’t one in the same. There are Three Ps that are critical to get right when selling your home: Preparation, Pricing and Promotion. Just like preparation (think painting and staging) and promotion (social content, print materials, etc.), pricing is a marketing tool. As with all our marketing, our goal is to reach the widest audience of potential buyers. The days of more than a dozen competing offers as the norm may be over (for now), but a list price on the conservative end of the estimated sales price has the ability to generate multiple competing offers — helping you get the highest price and most favorable terms.

Vacuums: Great for Rugs, Not for Selling Homes

While inventory may be low, your home always will be compared to other available homes (as well as those recently sold). The list price should take into account comparable properties, with the goal of being the best priced (and best presented) option for buyers. Depending on how much time has passed since you signed your listing agreement and are ready to go to market, that recommendation may change based on current market dynamics.

Nothing But Net

It’s easy to fixate on the list and sales prices, as they are what you see in marketing materials and what will post online and in public records when all is said and done. However, you should keep your focus on your net after you pay off your mortgage (if any) and closing costs. This is precisely why I go over estimated nets at various potential sales prices with clients, and together we set our sights on that bottom line.

Who Decides in the End?

While together we will set the list price, the market (i.e., homebuyers) ultimately sets the sales price. My role as your advisor and agent is to use data, trends and personal market insight to approximate that value so we can discuss a target net for you.

Finally, it’s also important to keep in mind that dollars aren’t the only currency in a transaction. For example, a buyer may offer you a 60-day rent back for free (worth two month’s of PITI) or they could offer to close in a week instead of 40 days (worth a month’s PITI). List price is simply a part, albeit a pivotal part, of the complex plan to make the most of your home’s sale — something that homeowners and their Realtors® always should discuss in depth and up front.

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

From Homeowner to Real Estate Investor: What You Need to Know

A good financial planner will advise you that you want to have diversity in your investment portfolio, with the mix depending on your risk profile, stage of life and short- and long-term goals. Homeownership is a great way to build wealth, as your housing costs are helping you gain equity (instead of paying someone else’s mortgage and expenses) and realize other advantages (from tax savings to simply enjoying making a home your own).

Photo Credit: PT Money

Many individuals and families will own a primary or secondary residence, perhaps a vacation home, but others will jump back into the market with the goal of acquiring a property purely as an investment. Some will join a REIT (real estate investment trust), while others will buy and hold (waiting to sell when the time is right) or flip (making improvements and selling right after). However, many investors will buy and become landlords, having someone else pay most or all of their mortgage (and, ultimately, securing equity over time).

In the DC area, we have a very fluid population, with people constantly coming to and leaving the area for work and study — meaning there’s a strong demand for rentals. And, while DC’s rate of population growth rate has slowed down a bit, the region continues to be a draw for individuals and businesses. So, what should you ask yourself if you and your financial advisor agree a new real estate investment may be right for you?

What’s my budget? Adding a property to your personal portfolio will require an initial investment and ongoing maintenance and carrying costs. You’ll want to consider the upper limit on your investment and then calculate the associated expenses — down payment (with higher requirements from lenders for investment properties), closing costs, professional fees (for the purchase, finding tenants and perhaps property management), maintenance reserves, etc.

Where’s the “sweet spot” in the market? An investment property may or may not be a property you could see yourself in. As an agent, I advise my clients on the state of the rental market and what types of properties (size, location, price point, etc.) are the most likely to be consistently in demand and rented with limited gaps in tenancy. Just because it doesn’t meet your needs, tastes and location preferences doesn’t mean it isn’t a good investment.

What’s my required capitalization rate and/or cash flow? Investors often evaluate potential properties by looking at their capitalization rate, or cap rate. Simply put, the cap rate is your annual return, calculated by dividing the net income by the market value of the property. In more competitive markets, like DC, lower rates might be expected. Another key consideration is your projected cash flow. Ideally, your rental income should cover the mortgage principal, interest, taxes and insurance on the property at minimum. If you are looking at investments that may have a slightly negative cash flow, take the time to even further evaluate if this is the best investment for you now. Perhaps you’d be better served by putting your funds into another short-term investment so you can increase your down payment and lower your PITI or by finding another property.

What type of landlord will I be? If you are buying an investment property near your home (or where you have a network already established), you may be able to self-manage your property. While this will require you to invest time and be on call 24-7, you will be reducing your ongoing expenses. However, carefully consider the trade-offs in time and stress if your budget allows you to outsource the property management (with fees running up to 10% of the rental income). Either way, if you haven’t already, familiarize yourself with landlord-tenant laws in your area. You’ll want to ensure, whether you are hiring a property manager or self-managing, that you are a well-respected landlord , abiding by rules and regulations and understanding the processes for handling any potential issues.

If you’ve asked yourself these questions and think acquiring an investment property may be right for you, reach out to an experienced agent to dig in deeper and talk about next steps in evaluating your readiness!

Expand Your Buying Options with Coops

Photo Credit: DC Cooperative Housing Coalition

With mortgage rates at the lowest they’ve been since 2016, buyers are finding their budgets stretching a bit further and maybe opening up more properties to consider for their new home. However, at the same time, inventory in bustling markets like the Washington, DC area is still low — especially at lower price points that appeal to first-time homebuyers (hovering around two-months in DC proper on average, but closer to one month in the $300-500,000 range).

If you’re searching regularly for new homes, you may come across that “condo” that appears too good to be true, asking yourself at first, “Is it really only $X?” and then looking at the monthly fee and wondering, “What amenities could cause the fee to be that high?” While there certainly are higher-end condo developments loaded with features and commensurate fees, you may have upon second look stumbled across a cooperative or coop.

Coops are investments like buying a detached home, townhouse or condo, with the primary difference being that you don’t own real property but instead own shares in a corporation that owns the property and, as such, are entitled to exclusive use of your unit in that property. You can take out a mortgage to fund your purchase price, which will be lower than comparable units in condo communities, and in turn you will pay monthly fees to cover coop amenities (from a concierge to a pool and some or all utilities) as well as your portion of the underlying corporate mortgage payment (if one exists). Some cooperatives have paid off their mortgages, meaning reduced fees for shareholders; however, the coop may at any time decide to take out a mortgage to fund repairs or enhancements (if approved by unit owners).

Capitol Hill Tower (1000 New Jersey Avenue SE), DC's Newest Coop

Photo Credit: DC Cooperative Housing Coalition

Other questions you will want to ask yourself when determining if a coop is right for you include:

Does your lender provide coop financing? Are they already familiar with and/or approved by the coop communities you are interested in?

Are there financing requirements the coop requires, such as a a minimum percentage down? Do you meet those?

How important is autonomy to you? Are you okay with potentially more restrictive policies (e.g., on renting your unit out, etc.)?

How well managed is the cooperative and are the financials in good order (just as with a condo or HOA, you will have an opportunity to review documents)?

What does the resale market look like?

While cities like New York City may be more well known for coops, there are more than 15,000 cooperative units in the DC area and, depending on your needs, it may be worth taking a first (or second) look at them if you are in the market to buy. And, if you’d like to learn more, the DC Cooperative Housing Coalition has great online resources…or, as anytime, reach out to me!

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

How Do You Know It's 'The One'?

Picturesque Georgetown

Photo Credit: Picssr

Some people fall in love with every home they see, while others can pick each one apart — identifying flaws that may be consequential or not. Having spent countless hours working with buyers with a range of budgets and needs, when they find “the one” it’s usually pretty clear to me (then we move onto the harder part of structuring the best offer so it becomes theirs).

While it’s true that you’ll often see a property for 15-30 minutes and then find yourself signing a contract of sale for hundreds of thousands of dollars to buy it, that doesn’t mean you can’t prepare yourself to make that swift decision more easily and recognize if you’re ready to take the next step in the homebuying process.

As you prepare to buy your first (or next home), here are a few ways I guide my clients and help them discern what’s best for them and that you can use to help you (or your clients):

Check(list) Yourself: Buying a home is an emotional process and you often have to go with your gut; however, that doesn’t mean throwing reason out the window. I always make sure to place a concise list of needs and wants at the top of showing sheets I prepare for my clients. This way, you can remind yourself that private outdoor space wasn’t a must but storage space was, for example. It’s easy to get distracted by shiny object (that gorgeous soaking tub!), so check yourself.

Compare and Contrast: While you definitely should compare each potential new home to your list of needs, you naturally may find yourself comparing it to other properties you have seen. For this reason, if time allows, it is sometimes helpful to see a few more properties after you think you’ve found the one you want to offer on — most likely confirming how your feel and strengthening your resolve to make it yours.

Picturing Your Future: One of the telltale signs someone is falling for a home is when they start placing their furniture (verbally) in a home and talking about how they would spend their time in the space. If you can envision not just special occasions but daily life in that home and neighborhood, it may be the perfect fit.

What If…: I often ask clients how they would feel if we just found out that the home in question just went under contract with another buyer. If you’d be kicking yourself for not acting faster, the game of “what if,” is a great final check before making your offer.

In the Washington, DC area, the market moves fast and it’s natural to be nervous about making such a big decision so quickly…but by stepping back briefly, holding yourself to a few simple “tests” and, most importantly, leaning on your real estate agent as a trusted advisor will make sure you can act confidently and give yourself the best chance of nabbing “the one” (or the next one)!

Become a Landlord or List?

It is rare that a person’s first home purchase is their “forever home” for a variety of reasons — from the cost of entering the market (especially in pricier markets like DC) to ever-evolving needs (as people marry, divorce, have children, grow older, etc.). When you make that decision that it’s time to find a new home, you also may have to decide if you want to keep your current home or find a new owner…and that can sometimes be an even tougher decision.

If you have paid off or down the mortgage on your first property, you may be in a position to buy your next home without selling (either your cash on hand and DTI ratio will allow or you may be able to apply some of the equity in your current home to help purchase your new home). When that’s the case, you are going to want to ask yourself a few key questions:

Do I want to be a landlord? If the answer is a definite “no,” proceed ahead talking with your agent about the best way to maximize your exit from your current property (considering timing and the three P’s). Similarly, if you live in a condo or coop that won’t allow you to rent out your unit (perhaps there is a blanket restriction or a limit on the percentage of units that can be rented), get ready to sell. However, if the answer is “maybe” or “yes,” proceed to the next question.

How will being a landlord impact my bottom line? If you have an outstanding mortgage, use that as the base for figuring out your break-even costs. Then take into account additional recurring costs, like condo and HOA fees, ongoing maintenance and paying a property manager (if applicable). Next, compare this to the going market rate for similar rental homes (have your agent gather comps for you and make a recommendation). If the carrying costs exceed or are close to your carrying costs, are you prepared to subsidize the difference to maintain ownership of the home? Also, don’t forget to keep in mind that your home will most likely not be rented 100% of the year and you will have costs to clean and prepare the home for the next tenant(s). Be conservative and calculate a 70-80% utilization if finances may be tight and re-run your numbers.

How will this impact my lifestyle? If you can’t afford to hire a property manager (or prefer not to), are you prepared to play that role, potentially getting late night calls when something goes wrong? If so, will you be local and be able to be hands on to ensure repairs are completed and handled in a timely manner? What if you run into larger issues with your tenant? For many people, this isn’t a bother at all. Thinking about how finances impact your lifestyle, if you will be running in the red to maintain ownership, don’t forget to consider how this will impact your purchasing power for your new home and your budget for daily living.

What are the potential long-term financial implications? Real estate is an investment and often the largest source of wealth for people. If you are more risk-adverse, real property can feel like a safe way of saving money (in fact, it is forced savings). However, if you prefer to play the stock market or identify other opportunities to invest, you may be able to put proceeds from a sale to a higher and better use. This is very personal consideration and there are no guarantees on returns in any investment, so engage your financial advisor to model out potential scenarios and choose what fits your risk profile and investment strategy. If you’ve dreamed of becoming a real estate mogul, this could just be the first step!

These are just a few of considerations I discuss with my clients during our one-on-one consultations. Being a real estate agent is about more than selling houses; it’s about helping people make their best housing and life decisions. There’s no singular best conclusion, but by enlisting the help of subject-matter experts — from your CPA and financial planner to a local Realtor — you can best discern the right path to your happiness at home.

And a shout out to Pearl and all the landlords out there…may you never have a tenant like this:

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Downsizing & Upgrading: Boomers Choosing Urban Life, Amenities

Photo Credit: Nicolas Huk

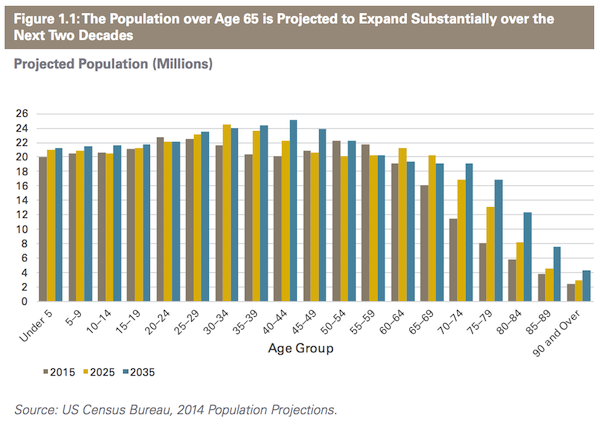

As people mature, it is common place to “trade up” in various areas of life — from the car you drive to the home you own. It’s a natural progression as salaries increase and investments grow, but it’s a choice many boomers are twisting a bit. Instead of buying that bigger house in the suburbs or country, they are choosing the convenience and efficiency of city living.

In some cases, older owners are selling their suburban homes and buying smaller homes or condos; others choose to keep the equity and decide to rent. In both instances, luxury finishes and ample amenities are often sought — from 24-hour concierge services to on-site pet spas for their four-legged companions. And the potential impact of this trend is undeniable, with the number of people aged 70 and over expected to increase by 90% to 28 million over the next two decades (according to a 2016 report by the Harvard Joint Center for Housing Studies).

In many cases, boomers are moving closer to family, allowing them to help with grandchildren, but there are other benefits to an urban lifestyle, including:

More public transportation options — decreasing or completely replacing reliance on driving;

Walkability to stores, doctors and more — increasing daily activity;

Opportunities for socializing and cultural activities — improving quality of life;

Access to more age-specific resources (such a those offered by the DC Office of Aging);

and many more.

Moreover, numerous studies point to the fact that people in urban settings, on average, live longer. So, is urban living right for you (or your parents)? Like everything in real estate (and many other areas of life), the answer for everyone is different. And with a boom in new urban suburban developments (like the Mosaic District in Fairfax, VA and Pike & Rose in North Bethesda, Maryland) it doesn’t have to be downtown or dirt roads.

If you or someone you love is thinking ahead to retirement and where to make the most of their golden years, feel free to contact me (just click/tap the button below)!

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

The Amazon Effect: Real Estate Reality or Hype?

Amazon. It has impacted our daily lives — from how we shop to what we watch — for years…but now it may have a greater impact for residents of two east coast communities: Arlington, Virginia and Long Island City, New York.

The selection process for Amazon’s HQ2 has been in the works for a while, so speculation about how it may impact the communities who were bidding for its business has been going on just as long. With the official announcement this morning that Amazon has selected two sites (and also will be bringing jobs to Nashville), the volume has been cranked up to 11.

Photo Credit: Wikipedia

From a residential real estate perspective, it is something that homeowners, potential buyers and sellers, investors and renters all should pay attention to (as if you could avoid it). What it is not is something that in and of itself is the reason to make an investment or decision to buy/sell. We will learn more details in the coming hours, weeks and months about the composition of jobs, timeline for hiring, etc. but here are some initial thoughts::

Not All Hires Will Be Moving Here: Part of what Amazon was looking for was communities with the right type of talent for their needs, so this doesn’t mean 25,000 new residents for the Washington, DC region necessarily. You will likely see talent pulled from other organizations (for example, Discovery Inc., which has made recent changes to how many employees it has in the area). The net impact remains to be seen, but the DC area is dynamic so, while significant, it’s not as big a percentage change as it could be for a smaller market.

Greater Buying Power: With attractive salaries, Amazon will likely bring on new talent who will see a salary bump, which means they may be more likely to make a real estate purchase — whether a first home, a larger home and/or an investment property. Higher salaries and attractive benefits also likely will put pressure on competing employers to match them to retain or recruit talent.

More Regional Moves: Current homeowners and renters who are hired by Amazon very well may decide to move to improve their commutes (as is common in an area known for commuter headaches). Expect to see greater interest in properties closest to Metro stations, especially on the Yellow and Blue lines. The region’s traffic woes are not going away anytime soon, so this will contribute to the trend of people seeking walkable communities with easy access to public transportation.

Rise in Renters: It is no secret that there has been a shortage of housing inventory for sale in the DC area for quite some time; meanwhile, the rental market has been less competitive. For those relocating to DC, they may choose to rent first and will be looking for nearby, updated options or those that provide a swift commute.

Catalyst for Change: The arrival of Amazon isn’t reason alone to buy, sell or invest but it is an important factor to consider — along with increasing interest rates, low inventory, etc. — when deciding what you best next move is.

So, what does this mean for YOU? The short answer is, it depends. If you have been dipping your toe in as a buyer, now may be the time to make that move before competition is likely to increase for the most desirable properties (as it normally does in spring but likely to a greater extent). If you are a homeowner looking to move up, you might want consider finding that new home sooner rather than later and evaluating whether listing or renting out your current home (for both the near- and long-term) is the best financial decision for you. And, if you are an investor or have been thinking about investing, there may be some good opportunities that come of this…but you’ll want to act swiftly (as many have already made their bets/investments).

There is no one answer for everyone and, no matter your feelings about the arrival of Amazon and its potential positive and negative impacts on housing affordability, traffic and more, it is a prime example of the complex dynamics you need to consider when making a real estate decision.

Is there a lot of hype? Absolutely.

Are all the accounts of potential impact exaggerated? No.

But, does hype have an impact on supply, demand and how people will act? Yes. Even if it’s more than it should have, it can work for and against you if you don’t think clearly.

Feel free to share your thoughts below and reach out if you’d like to talk about the potential impact on your 2019 (and remainder of 2018) real estate plans!

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Fall Market Update: What's In Store for Sellers & Buyers?

Source: Pxhere

If you’ve worked with a real estate agent to buy or sell a home, you know we are the first to let you know that we are many things but there are some things we are not — lawyers, accountants, tax advisors, inspectors, etc. You also can add psychic to that, meaning we cannot predict what your home will sell for in three years or what interest rates will rise to. That being said, we are in the field every day and are in a better position than most to spot signs of change in the market that could impact your strategy or decision making.

To that end, I wanted to share some statistics that provide food for thought and observations from my experiences and conversations with fellow Realtors® as we head into the fall market. Knowing when is the right time to buy or sell, while it certainly can be impacted by market dynamics, is really mostly about your personal situation. Have you outgrown your current home or are you moving out of the region? Do you have a new job and need a shorter commute? Is what you spend on rent more than what you would spend to buy a comparable or larger home? And those are just a few.

But back to some recent observations:

Housing inventory continues to be tight. When talking about the supply of housing, we look at the months of supply (i.e., if no other properties come on the market, how many months will it be until there are no homes left — assuming the same absorption rate as today). In August 2018 in Washington, DC, there was only 1.76 months of supply (Source: MRIS), which was actually up 9.5% versus last year. To put things in perspective, six months of supply is considered a balanced market. In Arlington, VA, that number increases to a whopping 1.87 (but that’s down nearly 17% from the same time last year). If we look toward Montgomery County, that number jumps to 2.96 in Bethesda but is the lowest of the four cities at 1.74 for Silver Spring. Of course, these numbers vary depending on the specific neighborhood and the housing type (see above) and size (e.g., for townhouses in DC, there is only 1.37 months of supply).

Interest rates are gradually rising. Interest rates have been slowly but surely increasing. In August 2018, the average commitment rate on 30-year fixed-rate mortgages was 4.55% (Source: Freddie Mac). In August 2017, that number was 3.88% with a 2017 average of 3.99%. By contrast, that annual average was as high as 8.05% in 2000. Overall, interest rates are still competitive (nowhere near the 18% rates seen in the fall of 1981) but locking in a rate now can save you meaningful money on your monthly payment and over the life of your mortgage (or until you refinance). It’s important to note that just because the Fed increases interest rates by 0.25%, for example, that doesn’t mean mortgage rates will go up a quarter point (however they usually trend in the same direction).

Average 30-Year Fixed Mortgage Rates (Source: Freddie Mac)

It’s still competitive out there…but not as much as before. It was only earlier this year that we were hearing stories of 15+ offers coming in on area properties. Of late, however, there are still many multiple offer situations and short offer deadlines but to lesser extremes. Many agents attribute this to buyer fatigue (yes, it’s wearing on you to make offer upon offer only to lose out…again). While a buyer last year that heard there was a deadline and multiple offers in hand may have put on their battle gear, some buyers now are talking themselves out of the running and not writing.

Pricing matters more than ever. Pricing is always the most important consideration when taking any property to market. Many sellers (and some agents) mistakenly think that because of the limited inventory and high demand, they can command large premiums. The truth is that while there will always be properties that set new records and buyers willing to waive appraisal contingencies, most buyers are closely examining the comps with their agent-advisor and nervous about overpaying (thinking there may be a growing housing bubble). An overpriced property can sit on the market for weeks or months longer than it should (and time is money, if you’re the seller).

So. what does this mean for you as a seller and/or buyer?

If you need to sell your home, now is a great time to do so (provided you price and market it correctly). However, be prepared to possibly face challenges buying your next home if you are staying in the region and talk to your lender and agent as to timing and how to best set yourself up for success.

If you’re ready to buy but not in a hurry, run the numbers. Having flexibility as to when you can or need to buy is a blessing and a curse. Having a little bit of urgency is helpful when making a decision but, with limited inventory, you can avoid being forced to make a less-than-ideal choice. As interest rates rise, your lender can help you model out the impact of future increases so you can take the extra cost into account when considering each property and the opportunity cost of waiting.

Always be prepared. As a buyer, if you’re ready to move swiftly, you may come out ahead. With lighter competition, what it takes to go from offer to contract may be less than you think. Consider working with a lender that can underwrite your file prior to placing an offer and be ready to see properties as soon as they hit the market (or to explore off-market opportunities your agent may bring to you).

Don’t decide what’s best for you by what others are doing and/or saying. This is true in life and real estate, isn’t it? I started off this post by reminding us that there are dozens of factors that can come into play when deciding whether to buy or sell. Information and analysis are key, so make sure you have a partner who will ask the tough questions (often more than once) and arm you with insights that will help you make the best decision for you.

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Renovating with a Purpose: Setting Strategy Before Style

When your space doesn't suit your needs as well as it used to, you may choose to make updates or move on to a home that's a better fit (which may also require updates, whether you are renting or selling). So, how do you decide what to spend your hard-earned money on?

Sometimes simply updating paint and small finishes is all that’s needed…

With the proliferation of befores and afters on TV, Pinterest, Instagram and beyond, it's tempting to tear down walls and embrace the latest trend but, before making any changes, you should do so with intention. If you are choosing to sell, a top-notch real estate agent will advise you on what updates you should take on to maximize your potential profit and minimize time on market. If you're not there yet or haven't gotten advice, here are a few questions you should ask before you start shopping for contractors and finishes:

Do I anticipate moving in five years or less? If you are planning to sell or rent your home immediately or in the next few years, you'll want to put the tightest filter on the renovations that you make. As you most likely have heard, kitchens and bathrooms often sell houses; however, that doesn't mean you need to re-do them. Sometimes simple updates like new appliances or countertops or painting vanities and staining grout are the smartest choice. If you are planning to keep the property but find tenants, your criteria should be even more selective and, in both cases for renovations that you do take on, remember that your goal is to not match your tastes perfectly but to appeal to the widest audience (while minimizing your investment within reason).

How will my house stack up to its competition? If you are selling or renting, the biggest misstep is often not understanding the local market (and I mean hyper-local) and your competition. While sand-in-place hardwood floors and marble countertops and a decorative backsplash may be the best of the best, is that the norm for your neighborhood? Will prospective buyers or tenants pay a premium for that? This doesn't mean you have to throw style and aesthetics out the window, but you should run the numbers and choose the best option for your budget and your target audience, most importantly.

Am I planning to stay indefinitely? If you do plan on staying in the home for years to come, it may make sense to splurge on higher-end finishes and custom features...if they will bring you joy (yes, happiness is worth investing in). In this case, think through the function and form of your spaces. What bothers you on a daily basis -- maybe kitchen drawers that stick or a lack of a laundry room near bedrooms? What have you seen in friend's homes that has you repeatedly saying, "I need that in my next home"? Finally, planning to stay doesn't mean you should inject every current trend in your renovation. Instead, make timeless choices and find less permanent/expensive ways to make your spaces current.

Of course, these questions are just the beginning of a project that should be purposeful. For some pouring over colors swatches and tile & hardware options is fun; for others, it's a chore. If you find yourself in the latter, don't hesitate to enlist the help of a professional. And, even if you enjoy it, an expert set of eyes can help you navigate a sea of choices at a range of price points.

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Three P's of Selling Your Home

The 3P’s In Action: This home went from listing to settlement in 3 weeks, selling 3x faster than the local median DOM and for 102% of list price when the median is 93%)!

In a hot real estate market, like the Washington, DC area, there sometimes is the misconception that all you need to do to sell a house is put a sign in the yard and list it on the MLS. However, there is much more that goes into selling a home...and doing it for the maximum price possible in the current market.

While there is a list of more than 100 things I do before listing a home for a client, I like to focus on the "Three Ps" when advising homeowners on what to expect in our initial consultation:

1. Preparation: Depending on the condition of your home, the market and your ability to invest in repairs and updates, there may be a short or long list of recommended items to tend to. Some will be absolutely necessary, like ensuring major systems are operational or that there is fresh, neutral paint throughout; while others may be advisable to increase your potential of top dollar, like updating features and fixtures in kitchens and bathrooms or staging your home.

Every property is different, and we'll talk through the reasoning behind each recommendation and why it may be a smart investment. Some projects may take a quick trip to Home Depot and a day of labor and others may require more planning and a professional. For this reason, you should consult with a real estate agent as soon as you know (or are fairly confident that) you will be selling. This allows Realtors like me to prepare a recommended plan and timeline, so you don't add undue stress to the homeselling process.

2. Pricing: At every initial consultation with a client, I will be prepared with a range of market insights, including relevant comparables (aka comps), so that I can make a recommendation on list price after seeing a client's home. That recommendation begins as a narrow range and where we land ultimately depends on the repairs and updates made, recent sales and available inventory at the time we list and other circumstances and requirements (e.g., you need a buyer who will allow you to rent back your home for 30-60 days).

Pricing, ultimately, is a means to an end...maximizing your net after paying off your mortgage (if applicable) and other closing costs. The right price will get the greatest number of potential buyers in the door and, in some cases, you may get multiple offers that could escalate above list price; in other instances, you may find the market telling you that it thinks your home is priced too high -- either by a lack of offers or only offers that are effectively below list. The goal is to price right from the beginning leveraging data but to be prepared to make a swift changed if needed.

3. Promotion: Preparing your home with repairs & updates, as well as staging and pricing it correctly are the foundation, but promotion is key to ensuring that you reach the right audiences. Promotion spans dozens of activities, including:

Professional Photography

Signage & Flyers

Custom Websites, Tours & URLs

Email Marketing to Agents & Potential Buyers

Open Houses for Neighbors, Agents & Buyers

Social Media Content, Especially Graphics & Video

Buyer Incentives, Like Home Warranties

There is no one-size-fits-all when it comes to promotion, so having an agent versed in PR, marketing and social media strategy is a huge asset. Strategic promotion will try to maximize the reach, but be targeted toward those who have the greatest potential of bringing or being a buyer.

As you can see in this brief exploration, there are seemingly limitless considerations that can have clear consequences on how much your home sells for (and how quickly). Ultimately, you're behind the wheel...but let a trusted agent be your navigator and partner on the road to the closing table.

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.

Setting the 'Stage' for a Successful Sale

Staging. If you turn on HGTV or talk to anyone who actively stalks neighborhood listings online (you know you do!), it's a hot topic that generates various opinions — from being expensive and overrated to a must in this market.

As an interior decorator and real estate agent, I have clearly seen the value of staging for sellers but also know that the process can be challenging for homeowners. With that in mind, I thought I'd share a few tips for those selling their home on how to approach the topic when the time comes to list:

- Staging vs. Interior Design: While it is not uncommon for interior designers and/or decorators to run staging businesses, interior design is not the same thing as staging. Staging focuses primarily on the visual aspects of spaces, while interior design (well, good interior design) focuses on the function just as much, if not more.

- Staging Is Expensive: While staging an empty house is not inexpensive, market research has proven time and time again that staging has a positive correlation with the contract price and length of time before contract. It is important to look at staging as an investment and not simply an expense because, if done well, you will recoup and make money because of it.

- It's All or Nothing: While you certainly will have more work to do if you are starting with an empty house, staging doesn't always mean fully furnishing every living space. For properties with more than two bedrooms, I sometimes recommend selective staging. You want to focus your efforts on the most important spaces to most buyers (living room, kitchen, master bedroom, etc.) and then add on other spaces as need and budget allows. For example, you may want to stage a smaller or potentially awkward space to illustrate how it can function, say as an office or nursery.

- No Need to Stage If I'm Living Here: If you are living in a house while it's on the market, that's an even bigger reason to stage your spaces. One of the services I offer my clients (and other Realtors) is working with their existing furniture and accessories to highlight their home and appeal to the most potential buyers. Decluttering and depersonalizing spaces is the first step in any staging plan.

- It's Personal: Selling a home is an emotional process, and it's important to realize the moment you decide you are selling that the home is no longer yours. As an agent, my goal is to help you meet yours — whether that's a high offer, quick close or any other number of terms. When you separate yourself from the property and realize the recommendations made and actions taken are necessary to reach your goals, you can appreciate (or at least tolerate) creating and living in a show home temporarily.

If you are thinking about selling your home, you have many choices when it comes to hiring a Realtor. Beyond setting the appropriate list price, marketing (which includes staging) is the most important factor in optimizing your outcome. Make sure your agent is an expert in real estate as well as all aspects of marketing (design, social media, digital advertising, etc.) and you'll be on your way to the closing table. And, of course, if you need that breadth and depth of experience in the DC metro area, you know where to find me!

Amber Harris is the owner of At Home DC and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.