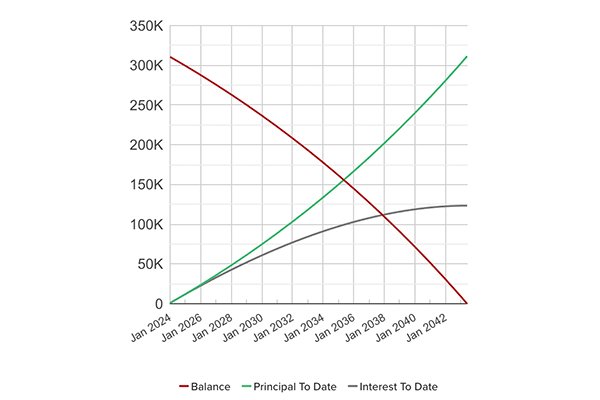

It may seem like your payments are all going to interest at first, but greater equity comes with time.

A recent post on The Atlantic proclaimed, "It Will Never Be a Good Time to Buy a House." And, while there are some hard truths outlined in the article (such as the lack of inventory and today’s higher interest rates), homeownership is about the long game and sitting on the sidelines doesn't equate to winning for most, especially if you haven't made your first investment. Renting is helping someone else gain equity or profit (if the home is owned outright), so investing in you as soon as possible is key. It can be a hard journey but we can do hard things, right?

Since numbers don't lie, let's look at an example of a first-time homebuyer who bought a two-bedroom condo in a on-the-rise neighborhood in DC ten years ago. Despite a good job, with the relatively high cost or real estate, he put down only 5% of the $429,000 sales price, understanding that this would mean an additional cost for private mortgage insurance (PMI) for a while. Closing costs, including the down payment, equated to just under $33,000 and the total monthly payment of PITI (principal, interest, taxes & insurance), PMI, and the condo fee equated to $2,750/month. At the time, the median rent for a similar unit was $2,200. Who would want to pay $550/month more? (Answer: Almost anyone planning to stay or hold onto the unit for five or more years)

After an early termination of his PMI due to him proactively requesting an appraisal due to rising property values in his neighborhood, let's fast forward to 2023. Today he is paying less than in 2013 ($2,550/month) without PMI and even with higher taxes, insurance and condo fees. That same unit would rent for $2,900/month on today's market (a 30+% increase, while he is paying 7% less than in 2013). As an owner-occupant, he'd be making out great. As an investor-landlord, he is clearly in the black -- now having someone else help him continue to gain equity and cover his mortgage (and then some). My how the tides have turned.

And this is just looking at his cost of living; however, here's the real magic: over those 10 years his property value appreciated more than 45% (or almost $200,000), while he also gained another $100,000 of equity by paying down his mortgage. During this time, he may have paid approximately $20,000 more in the early years to own vs. rent but, even with is $33,000 down payment, an investment of $53,000 that grows to $300,000 in 10 years isn't too shabby (that's just under a 19% annual return). Other benefits include stability, the peace of mind of being able to make his home own, the savings not having to move, etc. A home is one of the few investments you can enjoy while it appreciates. Even if he had sold five years in, the equity would have made a solid down payment on a new $1M+ home.

Yes, this is only one example. And, yes, interest rates back then were closer to 4% and the location of the home was on the rise...but the principals still apply. With a lack of housing supply, the S&P CoreLogic Case-Shiller Home Price Indices are near their highest inflation-adjusted levels. The price of entry may be higher but the trajectory in a vibrant market like the DC metro area is clear.

Even if your budget may be tighter due to higher interest rates and that first home may be a condo or townhouse instead of a detached home, time is your greatest asset in real estate. Whether you're in your 20s, 30s or beyond, you can crunch your numbers, make moves and invest in you. The average age of today's first-time homebuyer is at an all-time high, but that doesn't mean you can't beat the average (and I love helping first-time homebuyers make the leap with confidence). Curious in running your personal scenario? Reach out today and let's look at your financial situation, the variables you can change, and the market to see what your path may look like.

Amber Harris is the owner of At Home DC, an interior decorator and a licensed real estate agent with Keller Williams Capital Properties working with clients in DC, Maryland and Virginia.