While most buyers want a turnkey new home, many have dreams of finding and updating that fixer upper (thanks, HGTV) or, more commonly, can’t find that “perfect” property in their market due to limited inventory and/or budget.

Fortunately, if you don’t have the extra cash to put into updates (which is not uncommon with real estate prices in the DC area), there are financing options that let you tackle everything from a basic kitchen or bathroom update to more extensive renovations. To shed some light on these, I caught up with Duke Walker of Movement Mortgage, a native Washingtonian and current Capitol Hill resident who has helped hundreds of families in the region with their mortgage needs.

Walker

With limited inventory in the DC area, are you seeing more buyers considering and purchasing homes that they want to make renovations to right away? What mortgage options are there for those that may not be in a position to self-fund those?

Yes, there has been an increase in buyers looking at homes that are in-between “shell/unfinanceable” and “turnkey/brand new.” At Movement Mortgage, we offer and specialize in many renovation loans, which allow people to finance the purchase of the property in additional to the construction work needed to update the house to their specifications.

Can you briefly explain the different types of renovation loans and who they work best for?

There are renovation loans offered by FHA (203k), Fannie Mae/Conventional (HomeStyle) and the VA (Veterans Affairs).

There are two types of FHA loan, 203k Standard and 203k Limited. Both loans require only 3.5% down payment. Standard covers many “major” repairs, such as structural repairs, moving or altering a load-bearing wall, or even knocking the house down to rebuild it as long as you leave part of the existing foundation intact. 203k Limited covers a max of $35,000 toward repairs. This loan type is intended for less intensive changes or updates such as roof repair, replacement of HVAC systems, flooring or minor remodeling work.

The conventional reno loan is called HomeStyle. It has a minimum of 5% down but no minimum renovation cost required. HomeStyle also has an option for investors. It can be used on a single unit property with all renovation work allowed, including luxury additions, and a minimum down payment of 15%.

Download a chart comparing the various renovation products, courtesy of Movement Mortgage.

What are the major differences in the process between a “standard” mortgage and a renovation product?

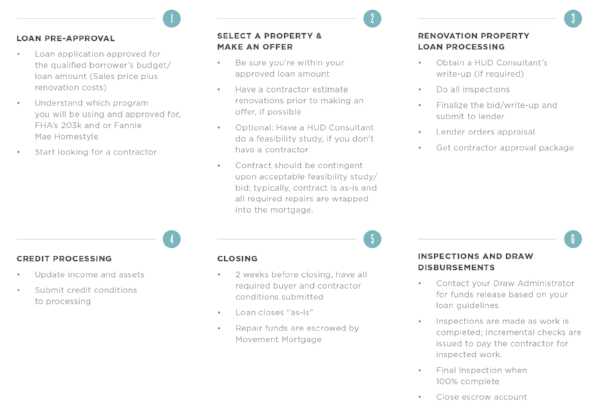

The primary difference is that a renovation loan requires a bid from a licensed contractor detailing the work to be done on the home. That bid has to be completed prior to an appraisal on the property. An appraiser will inspect and review the house in its current condition, as well as review the bid from the contractor in order to come up with what’s referred to as the “after improved value.” Often times, waiting on the bid can push the timeline out 7-10 days further than the “standard” mortgage approval process.

Can anyone do the reno? Could the borrower or a family member complete the renovation?

The work has to be done by a licensed contractor and that person cannot be the buyer or a family member of the buyer.

Are there any frequent misconceptions buyers (or agents) have about renovation loans?

The typical misconception has to do with the length of the process. It does not have to take forever. Most of our renovation loans go to close in 30-45 days, sometimes sooner. If the contractor is on board and motivated to do their part, there’s no reason it should take more than a month to close.

How can current homeowners take advantage of these options, whether they are planning to sell or not?

These renovation products can not only be used in a purchase transaction but also in a refinance. For example, if you wanted to put $30,000 into a kitchen remodel but don’t have the equity position for a HELOC (home equity line of credit) or extra cash lying around, you could roll that cost into a mortgage and build equity!

Is there any final advice you have for buyers, in general, looking to purchase in the coming year?

Don’t be afraid to get your hands dirty with a property. Some of the best deals out there are livable homes that just need a little bit of love. And don’t be afraid to talk with a mortgage lender such as myself. We don’t judge people. Our job is to guide and consult you from beginning to end of the home buying process. It never hurts to see where you stand financially and what possible loan products might be available to you.

Thank you to Duke for sharing his experience and knowledge, and feel free to connect with him on Facebook, Instagram and Twitter, or reach out to him for your specific questions and needs.